Standard Bank Denies Security Breach Amid Customer Concerns

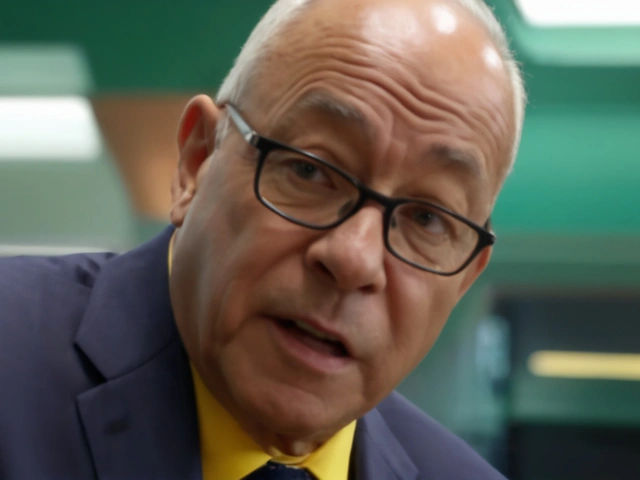

In recent developments, Standard Bank has come forth to categorically deny claims of a security breach following apprehensions raised by several customers about unusual activities on their accounts. According to the bank's spokesperson, Ross Linstrom, there is no basis for the fears surrounding a potential security breach. He assured that the bank's systems remain impenetrable and robust against cyber threats. Such a definitive statement aims to quell the worried sentiments among customers and to reinforce trust in the bank's security protocols.

Concerns initially arose when customers took to social media platforms to report unauthorized transactions on their accounts. The ensuing panic saw rapid speculation regarding the bank’s system security. However, Linstrom clarified that these suspicious activities were a result of phishing scams rather than any breach of the bank's systems. Phishing scams typically involve fraudsters sending deceptive emails or messages that replicate official communications to trick recipients into revealing sensitive information like login credentials and personal details.

Phishing Scams: A Persistent Threat

Phishing scams have become increasingly sophisticated, often mimicking legitimate bank correspondence with unnerving accuracy. These scams exploit human psychology, preying on the unsuspecting and the unwary. Linstrom elaborated on this, advising customers to stay alert and to scrutinize any unsolicited messages, even if they ostensibly appear to be from the bank. He emphasized the necessity of not responding to suspicious emails or messages and urged customers to remain vigilant against such nefarious activities.

Adding to the concern, the South African Banking Risk Information Centre (SABRIC) has also issued warnings about the surge in phishing scams. SABRIC highlighted that customers should treat unsolicited emails and messages with caution and verify the authenticity of any communication before responding. Regularly monitoring account statements for any signs of unauthorized activities is a crucial step in safeguarding one's financial data. This proactive approach can potentially mitigate the risk of falling prey to such scams.

Proactive Measures by Standard Bank

Standard Bank has advised customers to regularly check their accounts and to promptly report any discrepancies through the bank's dedicated fraud hotline. Such measures not only help in early detection of fraudulent activities but also enable the bank to take swift corrective actions to protect customer accounts. The institution has assured customers of their data's security and reiterated that robust systems of defense are in place.

In response to the concerns raised, the bank has ramped up its customer education initiatives. Informative campaigns are in motion to raise awareness about the various tactics employed by cybercriminals and to educate customers on safe banking practices. Standard Bank remains committed to continuously upgrading its security protocols to stay ahead of potential cyber threats.

Community Trust and Safety Assurance

The reassurance from Standard Bank has been critical in maintaining customer trust. Financial institutions heavily rely on the confidence customers place in them, and any indication of a security lapse can have far-reaching ramifications. By addressing these concerns head-on and providing transparent communication, Standard Bank aims to demonstrate its commitment to customer safety and data protection.

The bank’s proactivity in mitigating the panic caused by these phishing scams is indicative of its broader strategy to combat cyber threats. By focusing on both technological security measures and customer awareness, Standard Bank sets a robust example for other financial entities in the region.

Continued Vigilance Needed

In the digital age, cyber threats are ever-evolving, necessitating continued vigilance from both financial institutions and their customers. As cybercriminals devise increasingly sophisticated schemes, awareness and education become paramount. The collaboration between Standard Bank, its customers, and regulatory entities like SABRIC underscores a unified front against cybercrime.

As part of its advice, Standard Bank has highlighted several red flags that customers should be on the lookout for. These include unexpected emails asking for personal information, messages containing suspicious links or attachments, and any communications that convey urgencies, such as threats to shut down accounts unless immediate action is taken. By recognizing these common tactics, customers can more effectively guard against potential threats.

Moreover, it's crucial for customers to utilize the bank’s security features, such as two-factor authentication and regular password updates, to further secure their accounts. Standard Bank is also encouraging the use of its official mobile app, which has heightened security features compared to traditional browser-based access.

The Broader Context of Cybersecurity in Banking

The issue faced by Standard Bank and its customers is not isolated. Across the globe, financial institutions are grappling with the ever-increasing threat of cybercrime, particularly phishing scams. The banking sector remains a prime target for cybercriminals due to the valuable data and resources it holds. This scenario necessitates a multi-faceted approach to cybersecurity, combining advanced technology, constant vigilance, and informed customer practices.

Governments and regulatory bodies worldwide are continuously updating policies and regulations to tackle the escalating threat of cybercrime. This regulatory oversight provides an additional layer of defense, albeit the primary responsibility for secure banking lies with the institutions themselves.

Ultimately, the onus is on both the bank and its customers to foster a secure banking environment. While the bank invests in state-of-the-art cybersecurity measures, customers must remain alert and informed. This collective effort ensures a fortified defense against the relentless wave of cyber threats.

Looking Ahead

As Standard Bank continues to navigate the complexities of cybersecurity, the trust and safety of its customers remain paramount. The institution’s recent assertions and proactive measures reflect a commitment to maintaining top-tier security standards. As cyber threats persist and evolve, both customers and banks must adapt accordingly. With heightened awareness, advanced technology, and cooperative efforts between banks and customers, the battle against cybercrime can be effectively waged.

In conclusion, while the recent customer concerns have sparked fears, Standard Bank is unwavering in its assurance: its systems are secure, and no breach has occurred. Vigilance, education, and robust security measures stand as the bulwark against phishing scams, ensuring the safety and trust of all customers.

15 Comments

Standard Bank’s clear stance on phishing is a solid reminder that the real battleground is often the human element, not the firewall; we all share the responsibility to stay sharp, verify every message, and report anything suspicious, because a collective vigilance forms the strongest shield against deceitful actors.

Great to see the bank taking proactive steps – keep the community safe! 😊

From a cybersecurity governance perspective, the differentiation between a systemic intrusion and a social engineering vector is paramount; phishing, as a form of credential harvesting, exploits the trust relationship that banks have cultivated with their clientele. The recent communications from Standard Bank underscore the necessity for a layered defense strategy, wherein technological controls are complemented by continuous user education. While the bank’s infrastructure likely incorporates multi-factor authentication, intrusion detection systems, and encryption at rest, the attack surface expands whenever an individual inadvertently discloses authentication tokens. Consequently, the threat landscape is increasingly characterized by a convergence of low‑tech manipulation and high‑tech exploitation, requiring a holistic risk assessment framework. It is essential for institutions to adopt a zero‑trust mentality, assuming breach potential at every touchpoint, and to enforce strict verification protocols for any unsolicited correspondence. Moreover, regulatory bodies such as SABRIC provide valuable threat intelligence feeds that, when integrated into Security Information and Event Management platforms, can accelerate anomaly detection. The bank’s advisory to monitor account statements aligns with best practices in continuous monitoring, reducing dwell time for malicious actors. In addition, employing behavioral analytics can flag atypical login patterns, thereby mitigating the impact of compromised credentials. Customer awareness campaigns should be iterative, leveraging phishing simulation exercises to reinforce defensive habits. By cultivating a security‑first culture, banks not only protect assets but also preserve brand integrity, which is increasingly recognized as a critical intangible asset. The importance of rapid incident response cannot be overstated; a streamlined playbook enables containment within minutes rather than hours. Finally, as threat actors refine their phishing tactics-using personalized spear‑phishing and deepfake audio-continuous investment in both technology and human capital remains the cornerstone of resilience. Inter‑organizational collaboration, such as information sharing forums, further enhances collective defense capabilities by disseminating Indicators of Compromise promptly. Investing in AI‑driven email filtering can also reduce the volume of malicious messages reaching end‑users. Ultimately, the synergy between robust technical safeguards and an informed customer base forms the most effective barrier against phishing exploits. Standard Bank’s ongoing commitment to these principles serves as a benchmark for the industry.

Phishing attacks prey on our moral duty to protect personal information, and succumbing to them reflects a lapse in personal responsibility, even though the perpetrators are undeniably the true culprits.

I totally understand how unsettling these scams can feel; remember you’re not alone in this, and the bank’s resources-like the fraud hotline-are there to help you navigate any suspicious activity 😊.

It helps to set up alerts for any transaction over a certain amount and to double‑check the sender’s email address before clicking any link.

Wow!!! This is exactly why we need to stay on our toes!!! Keep those eyes peeled for anything that looks off, and never, ever share your passwords!!!

Stay vigilant and verify every request.

Our national financial infrastructure cannot afford any breach; therefore, deploying advanced threat intelligence platforms and zero‑trust architectures is non‑negotiable for safeguarding sovereign assets.

The bank’s PR spin obscures the fact that many customers remain uninformed about basic cyber hygiene, and without a rigorous, enforceable education mandate, these phishing incidents will persist.

Think of phishing as a wolf in digital sheep’s clothing-sleek, crafty, and always hungry for the simple trust we casually offer.

Dont worry, we all get tricked sometimes-just double check and report any weird emails fast.

It’s awesome seeing the bank push out security tips, and those little reminders can really make a difference for us everyday users 😊.

I recommend maintaining a regular schedule of reviewing account statements and utilizing the bank’s two‑factor authentication to reinforce your security posture.

Here’s a quick tip: enable biometric login on the app and set up transaction alerts to catch any unauthorized activity instantly 🚀.