As the Federal Reserve gears up for its third rate decision meeting of 2024 on May 1st, individuals and businesses alike are bracing for more of the same. High borrowing costs have burdened consumers and enterprises throughout recent months, and the upcoming decision by the Fed is expected to maintain the status quo, much to the chagrin of those hoping for relief.

Persistence of Inflation and the Federal Reserve's Stance

Inflation continues to be a dominant theme in the U.S. economic landscape, proving to be more stubborn than many economists originally anticipated. The relentless rise in prices has impeded economic growth and eroded the purchasing power of households across the nation. In response to these ongoing challenges, the Federal Reserve has adopted a cautious approach to monetary policy, aiming to curb inflation without stalling economic progress.

Experts, including economists from leading financial insights provider FactSet, predict that the Fed will hold interest rates steady during the May meeting. This decision is grounded in the necessity to continue monitoring economic indicators and inflation trends. Jacob Channel, a senior economist at LendingTree, highlights that the Fed remains determined to keep rates elevated until inflation is decisively under control. The expectations set by financial markets also align with these predictions, forecasting that any potential rate cuts will not occur before the end of the year, most likely during the Fed's September or November meetings.

Impact on Consumers and Borrowing Costs

This steadfast approach by the Federal Reserve means that consumers will not see a decrease in the costs associated with borrowing for some time. Everything from credit card debts to mortgage loans will continue to carry higher interest, placing additional strain on personal finances. The ripple effects of maintained high interest rates extend beyond individual consumers, affecting the broader economy, housing market stability, and even employment rates.

Given that higher interest rates typically slow down the demand for borrowing, businesses may also face hurdles. Investment can become more expensive and less appealing, potentially leading to slower economic expansion and innovation. The interconnectedness of interest rates with various facets of the economy illustrates the weight of the Federal Reserve's upcoming decision.

Looking Ahead: The Federal Reserve's Strategy

The Federal Open Market Committee (FOMC), responsible for setting the nation's monetary policy, meets several times each year to discuss and adjust economic strategies as needed. Their decision-making process is closely watched by economists, investors, and policy makers alike, given its significant implications on global financial markets.

For the upcoming announcement, the Committee's meeting will conclude at 2 p.m. Eastern time on May 1st, followed by a press conference led by Fed Chair Jerome Powell at 2:30 p.m. During this briefing, Powell is expected to outline the central bank's assessment of the current economic environment and justify their monetary policy stance. Observers are particularly keen on gaining insights into the Fed's long-term economic outlook and their strategies for tackling inflation without hindering growth.

As the date of the Federal Reserve's announcement approaches, all eyes will be on how the central bank plans to navigate the complex interplay of maintaining economic stability and controlling price levels. The decisions made by the Fed not only affect the U.S. economy but also set the tone for global financial markets. Thus, the outcomes of these meetings hold relevance far beyond the American monetary landscape, influencing economic policies and market movements around the world.

About the author

Melinda Hartfield

I am a journalist focusing on daily news across Africa. I have a passion for uncovering untold stories and delivering factual, engaging content. Through my writing, I aim to bring attention to both the challenges and progress within diverse communities. I collaborate with various media outlets to ensure broad coverage and impactful narratives.

Write a comment

Popular posts

Random posts

-

Limpopo Field Rangers Protest at Premier's Office Demanding Employment After Years of Unfulfilled Promises

In a pressing demand for jobs, around 200 Limpopo field rangers, trained in 2015, protested at the premier's office. The government's broken promise of employment has left many in financial and emotional strife.

-

Celtic Clinch 54th Scottish Premiership Title with Dramatic Comeback Against St Mirren

Celtic secured their 54th Scottish Premiership title after a thrilling 3-2 comeback victory over St Mirren in an electrifying match at Parkhead. Luis Palma’s late winner sealed the triumph after the visitors twice led through captain Mark O'Hara. The victory caps a dominant campaign, with Celtic finishing eight points ahead of arch-rivals Rangers. The season concludes with a Scottish Cup final clash against Rangers.

-

Impending Solar Storm May Illuminate British Skies with Northern Lights

An impending solar storm, resulting from a significant solar flare, is set to influence Earth's geomagnetic field. Britain may experience the aurora borealis, commonly known as the Northern Lights, due to this celestial event. The Met Office has issued a moderate storm warning, forecasting potential disruptions to satellite communications and power infrastructures.

-

Comprehensive Homesite Homeowners Insurance Review 2024: In-depth Analysis and Insights

Homesite Insurance, established in 1997 and part of American Family Insurance, offers a wide range of services nationwide, including homeowners, auto, and pet insurance. Known for its strong financial rating and customer satisfaction, the company provides additional coverages and discounts but lacks guaranteed replacement coverage and a mobile app.

-

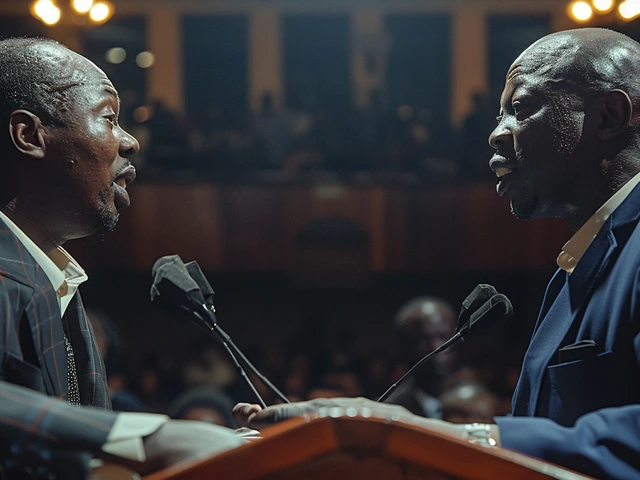

CS Moses Kuria and DP Gachagua Clash Over Limuru III Development Projects

Cabinet Secretary for Investment, Trade, and Industry, Moses Kuria, finds himself in a contentious dispute with Deputy President Rigathi Gachagua over development projects in the Limuru III area. Kuria accuses Gachagua of hijacking projects from the previous administration and interfering with the tendering process.